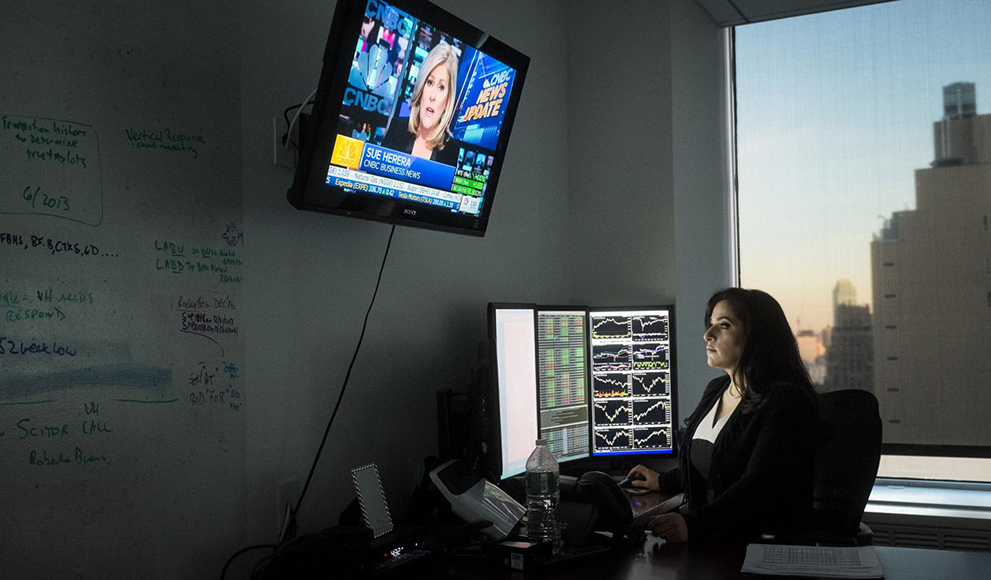

Victoria Hart '96 Founds "Seven Degrees of Women in Finance," a Network for Women in the Field

On Wall Street, hedge fund managers invest millions, even billions, for their clients. Research shows that over the past decade, women managers have consistently earned higher returns than men, yet they continue to find limited opportunities to advance in the field. To address this issue, Victoria Hart '96, who started her own hedge fund in 2012, founded an invitation-only network last year called Seven Degrees of Women in Finance. Her efforts were highlighted in a Newsweek magazine article—"If Women Are So Good at Managing Money, Why Are So Few of Them Doing It?"—earlier this year.

As the piece explained, "funds owned and run by women have returned an average of 59.43 percent since 2007, compared with an average of 36.69 percent for the whole industry." Women also experience fewer losses caused by overconfidence and overtrading, they exhibit greater discipline in their investing decisions, and they focus more on protecting their clients’ investments from risk.

Nevertheless, "[a]s of 2015, less than 2 percent of hedge funds were run or owned by women—about 150 to 200 globally—and the majority of those managed less than $100 million of funds."

The problem, Newsweek noted, is that investors tend to work with people they know and trust. Male fund managers are part of a powerful network, while women are not as well connected and are often viewed as less committed to their careers because they take time off to raise families.

Hart believes the latter is a misperception. "There is an uneven opportunity set for women because some lack access to established networks and relationships, which therefore makes them less visible. So the bridge to decision-makers isn't there," she said. "We have to find ways to construct and maintain those bridges, and navigate through some of the complexities faced by all professionals at senior levels."

The kind of peer-to-peer discussions Seven Degrees facilitates are crucial to that process. As one woman told the reporter, "I don't know too many other female chief investment officers, so Victoria's group really fills a void. I attended the third or fourth meeting of hers, and it was packed. Networking is so important in this business—with men and women—because you need to meet people who can supplement your skills, introduce you to other people and give you advice."

Hart said her experience at Wellesley and in the Worldwide Wellesley Network served as a blueprint for the group, which already has more than 200 members. "When you bring together a lot of like-minded women who bring a lot to the table, a powerful exchange can occur,” she said.

Hart, who majored in chemistry, credits Wellesley with teaching her the analytical skills she needed to work in finance. "Chemistry provided a good foundation because it explains everything around you and teaches you to digest massive volumes of data, remove the bad data, and spot the anomalies, in order to see something new or different," she said. "That pairs well with the financial markets, because the stock market has a lot of variables underneath, and one must understand how things are moving about and stand back to see the bigger picture."

As a college senior, Hart interviewed with several management consulting firms that recruited at Wellesley, as that strategic thinking appealed to her. She started her career as a management consultant specializing in chemicals and health care, and then moved to New York City, where she worked as an investment banker, a sell-side analyst, and later a buy-side analyst. She also received her MBA from Columbia Business School in 2002. That collective knowledge and experience—much like her well-rounded Wellesley education—enabled her to construct a more informed view of the market, which in turn has allowed her to forecast and react to a variety of situations, she said.

When Hart started her own hedge fund, she said she relied on something else she developed at Wellesley: "Determination to knock down any obstacles that are in your way. Wellesley women set a course and they don’t give up."

While nine out of 10 new businesses fail in the first year, Hart's has been successful, she said, because her clients know she can effectively manage money and she puts them first in all of her decision-making.

"Women usually have a long-range outlook, and we tend to wrap our actions in integrity. It’s not a minor point to run an organization with impeccable integrity at its core," she said, referencing some of the financial scandals during the past 10 years.

Hart believes that as women continue to support one another, clients and the industry itself will benefit. "It's important that women play a role in this field, or whatever field they are part of," she said. "Over time, some of the restrictions that have led to an uneven playing field will be eliminated, and women will see their efforts acknowledged and rewarded properly."